In 2015, a year marked by unprecedented M&A activity in the technology industry, Hewlett Packard Enterprise (itself a spin-off) made headlines with its announcement of plans to spin off its technology services operations and merge them with those of Computer Sciences.

As then-Chief Executive Meg Whitman told it, the deal was “game-changing,” “creating two great companies that are going to be more focused on a narrower set of businesses.”

Change is Never Easy

The market was less than convinced, though, with one analyst referring to the deal as “just a financial-engineering story.” Terms like “lumbering giant” and references to HPE “falling further and further behind” were also common in the aftermath of the announcement. There was even an almost nostalgic reference to HPs genesis as the “original ‘started in a garage’ company.”

Despite mixed sentiment, HPE shares rose more than 10% in after hours trading following the announcement on Tuesday. As the WSJ pointed out, the restructuring was “evidence of ongoing turmoil in the corporate computing market as business spending tightens and traditional data centers give way to cloud computing.”

While competitors like Dell and EMC took a merger approach to navigate this inflection point, Whitman decided on a breakup strategy. Though their approaches are different, the big players are united in a common goal: staying relevant in a rapidly changing tech landscape.

Leaning on Brand from the Beginning

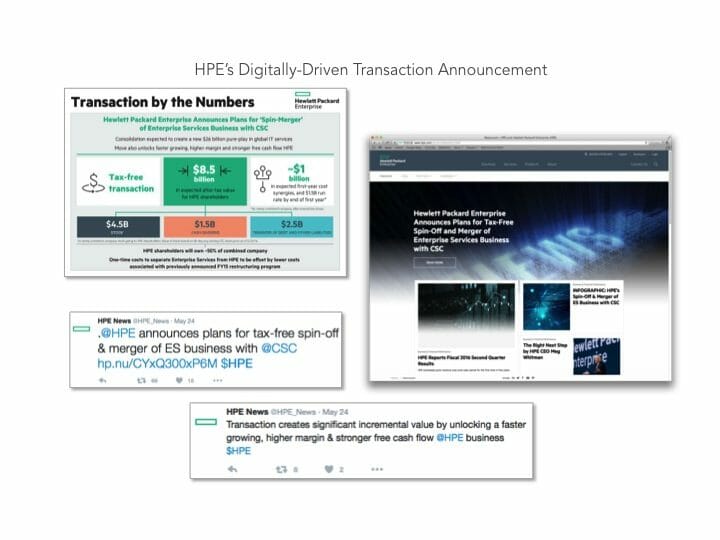

In what is surely a sign of the times, HPE announced its spinoff with a brand ready-made. Its launch included a “Transaction by the Numbers” infographic series. Dedicated landing pages created a targeted experience for visitors to the site. There was also a steady stream of communications through Twitter (now X).

This was an announcement strategy made for the digital age, and designed in phases to minimize disruption and confusion. It also allowed the company to include customers in its feedback loop, incorporating their suggestions and emphasizing the new company’s continued commitment to their accounts.

True to B2B best practices, HPE also provided its employees with copious guidance about the split and the resulting brand—not only in sales and marketing, but also in IT, product development, HR, and more. The company was able to do this in a very short timeframe, which was crucial to ensuring its people were able to properly evangelize the new brand externally.

What’s the “Why?”

With all the changes, it was critical that employees and investors had a clear understanding of what the company stands for. Without a clearly articulated vision and compelling benefit-driven story, the market will create its own narrative.

HPE needed to signal that although it was a separate and exciting entity, it was retaining HP’s pioneering heritage and reputation for high quality. One way it was able to successfully signal this was through a careful evolution of HP’s purpose.

While HP emphasized that its products enabled everyone to reinvent their worlds, HPE devoted itself to pushing businesses forward. In this way, HPE was able to demonstrate that it was still driven to create transformative technology, just in a more focused way. It was able to stake out a new, differentiated positioning while remaining true to HP’s original legacy.

For HPE—or any company going through a major restructuring to remain competitive in a disruptive marketplace—it’s important to remember that “staying relevant” doesn’t just happen on the balance sheet.

Employees will work harder and smarter and build lasting relationships with customers and prospects if they’re inspired by a clearly defined and articulated purpose—in other words, a brand. Understanding the “Why” behind the newly organized company will generate trust, and ultimately that will translate externally, helping to build the brand’s meaning with customers.

Wondering about how brand can help drive the success of your spin-off? Let’s talk.

Subscribe to Our Newsletter

Originally published April 26, 2020.