Mergers and acquisitions remain one of the fastest ways for companies to gain market share, expand capabilities, and accelerate growth. Despite shifting economic conditions, dealmaking continues to be a priority—particularly in high-growth industries like technology, where businesses must scale rapidly to stay competitive. And while financials often dominate the conversation, the success of a deal depends just as much on what happens after the transaction closes.

How do newly combined companies realize their full potential? As brand strategists, we’ve seen firsthand that success often relies on more than just operational synergies. How the newly merged entity tells its story, articulates its value, and connects with investors, customers, and employees plays a critical role in maximizing long-term value.

This is especially true for high-growth tech companies navigating complex sales cycles and competing for top talent in a crowded market. For marketing executives at newly merged companies, the to-do list can be overwhelming—especially when it comes to brand. To cut through the clutter and position the brand for success, we recommend focusing on these three priorities first.

The Top 3 Priorities for Tech Marketers Navigating M&A

1. Find your “Why”

One of the biggest challenges that technology firms will face following a merger is dealing with a growing portfolio that no longer seems to fit into a cohesive story. The companies we work with have often grown through multiple acquisitions or are expanding product portfolios, moving beyond their core story to one that lacks cohesion and that employees and clients can’t articulate.

The common problem in these situations is that that the newly structured company is too focused on the “What”—the products and solutions it offers. This is holding them back from talking about the “Why”: the reason the company exists, its vision and higher purpose, and the ultimate impact it intends to have on those it serves.

More broadly, finding a company’s “Why”—and identifying how this evolves with acquisitions and growing product portfolios—enables the firm to move beyond the nuts and bolts of specific services or products that may seem incongruent or conflicting. Going higher means finding a story that all audiences can connect with and believe in. It gives a company’s own people a rallying cry and a story to tell that’s not driven by any one business unit or product. Instead, it’s inspiration that all can get behind.

2. Establish your “What”

Companies following a growth-through-acquisition strategy often suffer from a lack of integration between acquired brands and the parent. This is especially true in an industry as product-driven and ever-evolving as technology. The result is a portfolio filled with repetitive, contradictory offerings, logos and names, creating challenges for sales people and customers alike in understanding what the company does.

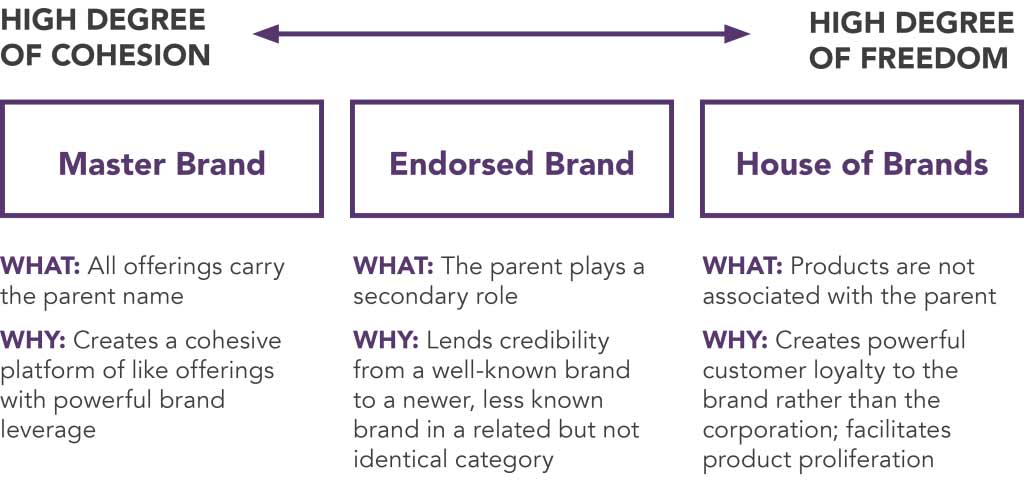

Brand architecture is the framework that defines the hierarchy, relationships and differentiation among brands from both sides of an M&A transaction. It provides a useful tool for streamlining this integration in support of the business strategy and brand goals. Skipping this step—which requires an understanding of the customer base, competitive landscape and company priorities—can lead to redundancy, inconsistency and confusion inside and outside of the company.

3. Empower your “Who”

If employees of the newly merged technology company do not feel connected to the new company dynamic, their customers and the market surrounding the business will feel that much more hesitant to accept the merger as a potential success. On the flip side, employees that have a strong bond and clear understanding of the corporate brand can be a company’s most effective communications channel.

Keep this in mind: for employees, a M&A usually means one thing: change. Change can be scary, often met with apprehension and negativity stemming from uncertainty and confusion.

To get employees behind the vision for the company and galvanize them into action, you must first appeal to these most basic instincts. This can be achieved by clearly defining what the combination means for them and how it will help them be more successful. Once their minds are at ease and their hearts are in the game, employees will want to connect with the new company and make the changes necessary to ensure the success of the combination.

Start with a Solid Foundation

Marketing executives who have gone through an M&A—in technology, or really any B2B industry—know firsthand that closing the deal is only the first step. Success requires a consistent and compelling brand that empowers the newly combined entity to translate the strong financial and strategic rationale of the transaction into a value proposition for employees and customers.

Implementation can take weeks, months or even years depending on many factors, including the breadth of target markets and complexity of the product portfolio. It takes a lot of effort on everyone’s part, and that’s why it’s critical to start with the right brand foundation.

Focusing attention on these three fundamental building blocks of the brand will ensure you begin from a place of strength as you move beyond the deal.

Want to discuss navigating your M&A to build a solid brand foundation—one that connects with the people who matter most? Let’s talk.

Subscribe to Our Newsletter

Originally published June 21, 2018.