Subscribe to Our Newsletter

According to Harvard Business Review, the failure rate of mergers and acquisitions ranges from 70–90%. Many factors can contribute to the success or failure of companies being combined. But too often, brand is not championed or leveraged during these critical moments—even though it can provide clarity and inspire invaluable unity across essential audiences, greatly improving the new entity’s chances for success.

Why would this be? Mergers and acquisitions are often viewed from a financial perspective, with more seemingly concrete assets (e.g., real estate, inventory) grounding investors’ perceptions of the deal’s value. But M&A success can hinge on far less tangible factors. One of these—brand—can play a critical role in communicating the promise of the merged entity and maximizing the value it creates.

Brand is much more than a name, logo or tagline. Brand communicates a company’s unique reason for being and how it meets the needs of customers, investors and employees, differentiating the business from its competition in ways that are compelling and memorable.

Following a merger or acquisition, brand can help a business translate the financial/strategic rationales for a deal into a value proposition that captivates customers and inspires employees. People remember stories up to 22 times more than they remember facts alone, making brand a powerful tool for influencing their thoughts, feelings and perceptions about the new business.

With so many steps required to execute successful mergers and acquisitions, it’s easy to place some items higher on the priority list than others. Here are the two most fundamental brand imperatives for driving M&A success—deserving of attention before, during and after any deal:

1. Align Business and Brand Strategy

The success of a merger or acquisition begins with aligning the business strategy with the brand strategy—first establishing a deep understanding of why the merger or acquisition makes financial and competitive sense for both companies, then crafting a story that will resonate with all internal and external audiences.

People need reasons to believe that the new entity understands them and will help them meet their challenges. Brand provides a framework for telling that story simply and powerfully—differentiating the new company in the context of its most important audiences’ needs and hopes.

Find the Connective Tissue

To turn a newly merged company into a world-class brand, begin by identifying the shared DNA of the pre-merger businesses. How will two or more companies, successful on their own, bring greater opportunity and value to their clients as a single entity? Exposing the red thread that links them—not only by what they do, but why they do it—can help inform the new, combined company’s point of difference and its enhanced value in the market.

Case Study

Communicating a Stronger Value Proposition Post-merger

DeSantis Breindel built the brand for New Jersey’s CarePoint Health, created by the merger of three regional hospitals. Patient research revealed genuine frustration over the complexity of accessing healthcare. And the merger made something new, valuable and truly differentiated possible: simplifying and elevating everyday care across one local, unified system.

- Empathetic messaging affirmed patient priorities: “Top doctors with the skill that really counts. Listening. That’s the point.”

- Caregiver outreach offered the chance to provide hands-on, personalized care—the experience that inspires people to practice medicine in the first place.

Once activated across media and patient and physician journeys, the brand thrived. CarePoint saw a measurable increase in both patient satisfaction and overall care quality, and the brand attracted leading physician groups to become part of its system.

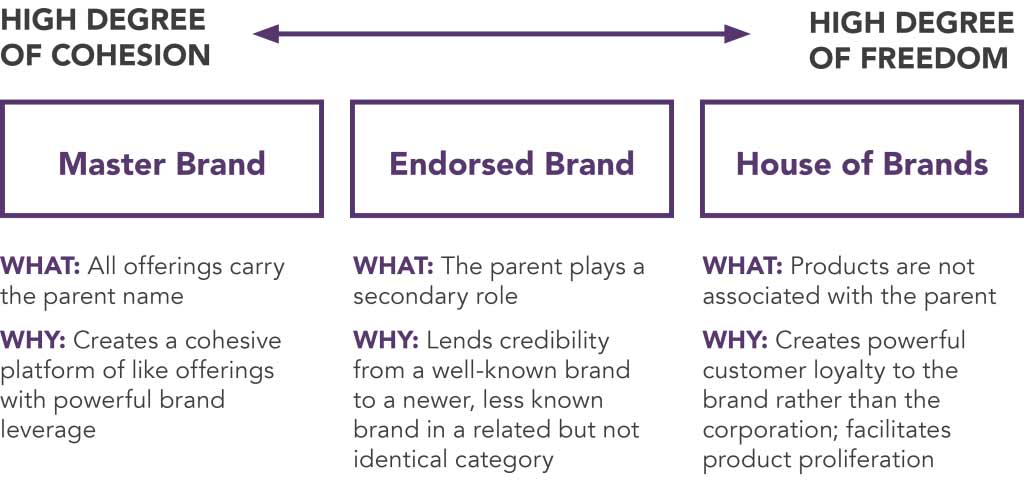

Establish a Cohesive Brand Architecture

Brand architecture organizes a business’s portfolio of offerings, clarifying the relationships between brands and sub-brands. In the case of M&A deals, brands from both sides of the transaction need to find their new place in relation to each other.

Building clear and cohesive brand architecture is critical for shaping the new company’s marketing efforts. Skipping this step can lead to messaging redundancy, inconsistency and confusion.

When companies grow through acquisition, they often buy market share and extend into adjacent markets. But when these acquisitions are not properly integrated into the parent brand, the result is often a portfolio filled with repetitive, contradictory offerings, logos and names. Salespeople and customers alike can struggle to understand what the new company does and what value it offers.

There are several ways to organize brand architecture, each with its own strengths and providing its own benefits to the business:

Once brand architecture is clear, it’s time to design the future of the merged portfolios. This requires developing deep understanding of customer bases, competitive landscapes and company priorities—then making plans to advance the vision, starting with unifying and galvanizing combined workforces.

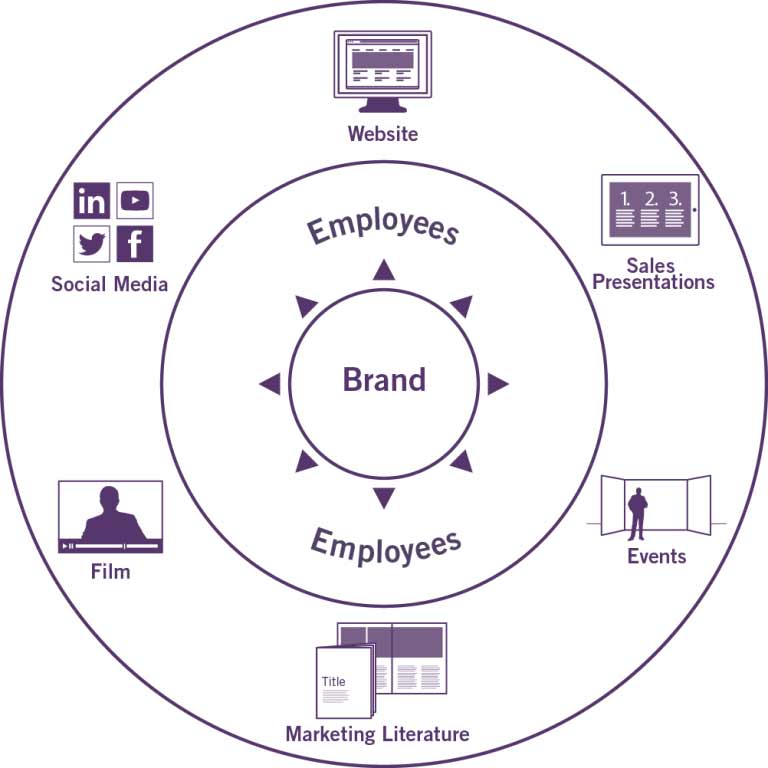

2. Build the Brand from the Inside Out

Once a brand’s path is developed, its new purpose needs to be clarified to the team—and lived by them. It’s important to formalize the behaviors that align with the brand’s new purpose and to develop an employee culture that makes people feel connected to the M&A deal and even empowered by it. This can motivate them to move forward and accomplish great things together.

For employees, a merger or an acquisition usually means one thing: change. Change can be unnerving, and it’s often met with apprehension and negativity stemming from uncertainty or confusion. So the success of a merger or acquisition can rest on winning employees’ hearts as well as their minds. A new sense of purpose can help them leave the past behind and look to the future with energy and optimism.

When a company fails to articulate a unifying new purpose to its newly-combined employee base, it can have a very difficult time shaping consistent experiences across external audiences. Employees will work harder and smarter to build lasting relationships with clients and prospects when they feel connected to purpose and make less effort when they don’t.

When employees become brand ambassadors who live the brand, providing a consistent experience, it builds customer trust and shapes what the brand means to them. Employee consideration and support is especially important in B2B companies, where employees represent the most powerful external communications channel.

Getting employees behind tomorrow’s vision and motivating them to action requires inspiring them to live the brand, including helping them see how the new brand will help them be more successful. But once their minds are at ease and their hearts are in the game, employees will want to connect with the new entity. They’ll make the day-to-day changes necessary to ensure its success.

Case Study

Building a Brand to Unite and Inspire Merged Teams from Day One

Quaker Chemical and Houghton International were both leaders in the global industrial fluids market when they announced their merger and became Quaker Houghton. Unifying workforces after a merger or acquisition is always an imperative. But when competitors join forces, the challenge can be complex.

DeSantis Breindel worked with Quaker Houghton to build a new brand that could help internal teams (as well as customers) understand the value created by the merger. We built upon a key insight: customers expected quality products and great service, but they yearned for expertise about their challenges. They truly valued the human ingenuity behind every solution.

Quaker Houghton’s new tagline, “Forward Together,” positioned the merger as a union of powerful teams—experts so wholly committed to the success of customers that they joined forces to put them first. The company’s new logo symbolized forces coming together to flow in the same direction, while messaging stressed the team’s knowledge, skills and resourcefulness.

In a market often focused on product specs, this spotlight on experienced, dedicated people differentiated the Quaker Houghton brand. It also inspired employees to live the new brand as one united, industry-leading team—one that is recognized and valued for their tireless drive to innovate.

3. Get Beyond “The Deal”

A merger or an acquisition will likely happen at some point in the lifespan of any successful company. To maximize value creation and improve chances of success, turn attention to the future of the new organization and leverage brand to shape the perceptions and actions of employees, investors, customers and partners.

Focus on finding the connective tissue between the companies and organizing it in a way that makes sense for the business and the brand alike. Mobilize the workforce to demonstrate and communicate the human side of the business transaction to bring the new brand to life. Never underestimate brand and its ability to make or break the success of an M&A transaction. It is a critical success factor—not just another item on a long post-merger to-do list.

To learn more about branding for M&A success, contact us.